There are ways President Trump’s re-election could impact the housing market overall; however, the outlook for the Pittsburgh housing market will again turn on changes in supply, not demand. Pittsburghers will have to settle for slow and steady once again.

Setting the rhetoric aside, the U.S. housing market needs improvement in two key areas to move in a better direction. Any policies aimed at improving affordability will be rendered lame unless there is certainty and acceptance of the mortgage rates and an increase in the inventory of homes to purchase, either through more existing homes for sale or new construction.

The federal government can have significant impact on both issues with very little policy action, particularly following a period where much policy action has been taken. The incoming Trump administration has signaled that it wants to act on several fronts that could impact mortgage rates and inventory. The latter would come from reduced regulation, which could lower the risk and cost of new development and incentivize lending. Trump administration actions on immigration and tariffs could have an inflationary effect on the economy, increasing the likelihood that long-term interest rates will remain closer to seven percent than five percent.

Elections always have consequences. Those consequences are typically less dire and dramatic than the forecasters predict. While many of Donald Trump’s campaign promises could produce dramatic reactions, it is comforting to remember that his election turned on the perception of better economic conditions. The state of the economy was a driving factor in President Trump’s first administration and will likely remain a high priority in his second term. In the final analysis, there are some ways Trump’s re-election could impact the housing market overall; however, the outlook for the Pittsburgh housing market will again turn on changes in supply, not demand.

The Mortgage Outlook

When the rate of inflation started falling more rapidly in fall 2023, home buyers and real estate agents began looking forward to the Federal Reserve Bank’s decision to reverse its monetary tightening policy and begin cutting interest rates. After some concerns about re-inflation in the first quarter of 2024, inflation cooled consistently, and the labor market slowed sufficiently for the Fed to cut rates by half a percentage point in September 2024.

The move, which was accompanied by remarks from Fed Chair Jerome Powell that suggested rates could fall by two percentage points by the end of 2025, sparked optimism in the stock and bond markets. Long-term rates fell sharply, including the 30-year mortgage rate, which dropped to nearly six percent in the week following the Fed cut. Then things changed.

Mortgage rates climbed slowly but steadily through October and November. By Thanksgiving, 30-year fixed rates were higher than they had been in July.

“There was anticipation in August that the Fed was going to cut by one half because the inflation was getting under control,” recalls Mike Henry, senior vice president at Dollar Bank. “We were almost down to 5.99 percent for a 30-year fixed after the Fed cut the rates but the information that came afterwards showed a bit more inflation in the market that would cause them to slow the rate cuts. The statements that were made caused the rates to go back up from 5.99 to seven.”

“Unfortunately, there’s a belief that the Fed rate has a direct impact on mortgage rates. The Fed rate impacts the bond market, and the bond market is what impacts mortgage rates. There are many factors that influence the bond market,” says Rick Ball, vice president director of Pittsburgh Mortgage Group at Community Bank. “It is far better for someone to track the 10-year Treasury to anticipate what mortgage rates will do.”

Henry notes that long-term rates, whether they are residential mortgages or U.S. Treasury bonds, are dependent on the perceived rate of inflation during the duration of the loan. While 10 years has proven to be difficult to forecast, let alone 30 years, when current conditions appear to be trending upward, lenders will tag a mortgage rate to what the bond market is asking for as an inflation premium. That is commonly based on the 10-year Treasury yield. Shortly after the September Federal Open Market Committee, bond traders began getting skittish about how quickly inflation would return to two percent and long-term bond yields rose.

“When everybody thinks the market is going to move a certain way and it doesn’t, there is a knee-jerk reaction. I think that’s what we have seen since September,” says Ball.

The mortgage market prices loans by adding a spread – a risk premium – to benchmark long-term bond yields, like the 10-year Treasury. The Mortgage Bankers Association (MBA) forecasts that the 10-year Treasury will float around two percentage points higher than inflation expectations, and the MBA predicts that the 10-year Treasury will not go much lower than four percent in the foreseeable future. Lenders typically add 1.5 percent to 2.5 percent to the 10-year yield when pricing mortgage rates. In times of uncertainty about inflation, like 2024, that spread will be at the higher end of that range. So, when the 10-year drifted back to 4.5 percent in October, residential mortgage rates moved back closer to seven percent.

There was good news as the year ended. Following two more Fed cuts of one-quarter percent, and data on the economy that suggests that higher inflation is unlikely, lenders have reduced their spreads for residential mortgages. In the week before Christmas, the 30-year fixed rate mortgage averaged 6.5 percent.

While the residential mortgage market is currently calmer in its outlook, there is less optimism that 2025 will bring a dramatic reduction in rates. In fact, there is unanimity that a return to the pre-pandemic rate environment is not in the cards.

The increase in mortgage rates since the September Fed meeting left Fannie Mae economists more cautious about the housing market in 2025. Fannie Mae significantly slashed its existing home sales forecast to a gain of just 4 percent next year from the previous 11 percent. Furthermore, it no longer expects mortgage rates to sink below 6 percent next year. Its outlook for this year’s fourth quarter is for an average of 6.6 percent, up from 6.5 percent in October. That is a significant revision in comparison to October’s call for rates to be at 6 percent in the final three months of the year. The 30-year fixed rate average will moderate over the next four quarters, but only drop to 6.3 percent by year-end 2025, and to 6.1 percent by the final quarter of 2026. It previously expected rates to average 5.7 percent next year.

Wells Fargo also substantially increased its outlook for 2025. After forecasting in September that the 30-year fixed rate would fall below six percent in the second quarter of 2025 (and fall to 5.5 percent in 2026), Wells Fargo upped its forecast to 6.2 percent through 2026 in its December outlook.

The MBA now forecasts that the rate for a 30-year mortgage will fall between 6.4 and 6.6 percent in 2025, an increase of half a percentage point from its October 2024 forecast. MBA expects the same mortgage will settle at 6.3 percent in 2026.

Henry agrees with the more cautious outlooks. When asked what it would take to get rates down to five percent, Henry says that he expects the Fed will be less aggressive in 2025 than in 2024.

“I can’t imagine at this point what would get it to 5.5 percent. Maybe if the Fed keeps cutting but I don’t know if that is what the Fed’s going to do,” he says. “If they were to cut another full point, they will be signaling that inflation is under control and that’s what mortgage rates are going to respond to. If the market feels that inflation is down the mortgage rates will follow.”

“If you had asked me in August, I would have expected we would finish in the high fives in 2025. Now, looking at all the factors, I feel the rates will be above six percent for 2025. We may see the low sixes by the end of 2025,” agrees Ball. “We would really need some significant changes in the overall economy and we’re not seeing that. We’re still seeing a stable job market. We’re not seeing the changes we would need to see to bring confidence to the bond market.”

Mortgage rates always matter to the housing market, but lower rates are especially important to the market now. Because rates rose so far, so fast, an overwhelming share of homeowners in the U.S. have mortgages that were closed when the interest rate was two or three percentage points lower. With each passing year that share erodes, but roughly 60 percent of homeowners have mortgage rates below four percent, according to Freddie Mac. Selling a home with a sub-four percent mortgage today would cost the average homeowner approximately $800 per month more if the amount borrowed was the same. That is a powerful disincentive to trading up or first-time buying.

Homeowners are less likely to be able to count on supercharged home equity growth in 2025. Research by real estate information service CoreLogic found that the pace of home equity growth slowed markedly in the third quarter, to an annualized 2.5 percent rate. That followed growth rates of 9.6 percent and 8.0 percent in the first and second quarters respectively. Borrowers will need to have more untapped home equity going forward, rather than relying on rising appraisals. Cumulative home equity nonetheless stands at an all-time high of $17.5 trillion.

With inflation mostly returned to its long-term levels, it was hoped that mortgage rates would fall meaningfully over the coming year. While it appears certain that mortgage rates will be lower, it is unlikely that the housing market will be given a boost by substantially lower borrowing costs.

The Residential Sales Outlook

The gloomier mortgage rate outlook will weigh somewhat on home sales in 2025. A combination of factors, mostly unrelated to each other, are creating a large reserve of pent-up supply in the housing market, including in Pittsburgh. Economic disruptions frequently lead to declining demand, which builds for a time before driving a robust recovery. In 2025, the market finds itself with plenty of demand. What it lacks, and has lacked since 2021, is a sufficient supply of homes for sale. That is changing, but not as quickly as the market requires.

“Buyer demand is still robust and will be even stronger going into 2025. A lot of that has to do with demographics and the entry of more of the Gen Z and Millennial generations into the market,” says Howard “Hoby” Hanna, IV, CEO of Howard Hanna Real Estate Services. “The Millennials are the driver of the economy now. As those Millennials enter their higher earning years, they will want to trade up into bigger homes or different school systems.”

Hanna reports an increase in traffic at open houses and in online shopping, although he says that the latter appears to be more educational or aspirational, as many of the online visitors do not request follow-up from an agent. He also believes the surge in the stock market will fuel an increase in sales at the luxury end of the market in 2025.

“We don’t need demand to rise to get back to normal or a better than normal market. The inventory is the issue,” says Tom Hosack, president/CEO of Berkshire Hathaway Home Services The Preferred Realty. “The inventory is rising, but some of that is what I call ‘make me move’ sellers. They see what their neighbor got and are figuring if I can get $50,000 more, I will sell my house. It’s not likely to sell at that price.”

Not surprisingly, Hosack sees the higher mortgage rates as the culprit in “locking” potential sellers in place.

“The change in interest rate makes the home so much less affordable. We need to see rates come down, which I think they’re going to,” he predicts. “When you combine that unlocking with the estimated 30 percent of the people that bought during COVID who hate their house, plus the normal pent-up demand from people who had kids and wanted to move up or wanted to move due to other changes in circumstances, there could be a lot more homes on the market.”

“I think if rates can get consistent in the sixes, that will free even people who bought that first home in 2020 and 2021 with very low rates too move up if their family unit has grown or their lifestyle has changed,” predicts Hanna. “Even if you’re locked into a three percent interest rate, it may start to make a little more sense, if not financially for the lifestyle difference.”

The current increase in inventory is significant, both in terms of the amount of increase and how far it needs to rebound.

According to Realtor.com, the number of active listings in the Pittsburgh Core Based Statistical Area (which includes Weirton/Steubenville, Hermitage, and Indiana) jumped 19.3 percent year-over-year in October, reversing a decade-long trend of declining inventory of homes for sale. There were 5,197 homes listed in October. Other than the post-pandemic rebound of eight percent in October 2022, the number of homes for sale in October has fallen every year since 2015, with most years seeing double-digit declines. The October 2024 listings were 50.5 percent lower than October 2016.

The Pittsburgh Business Times found that there were 8,435 residential real estate transactions over $300,000 completed by mid-December 2024 in the six-county metropolitan Pittsburgh area. That compared favorably to 7,422 during the same period in 2023.

I think we’re still going to have a challenge getting an inventory that is either equalized or normalized. We’re seeing pockets of increased inventory and days on market is starting to increase, but it’s still a challenge” Hanna says. “I see a small uptick year-over-year in inventory in 2025, but it won’t be enough to normalize and make it a buyer’s market or even an equal market. I believe that will flush itself out over the next 18 months to two years.”

The Construction Outlook

The new residential construction market resembles the home sales market in Pittsburgh. There is plenty of demand for new homes, but the inventory is not growing fast enough to meet that demand. The new construction market has an additional supply problem: there are not enough skilled workers.

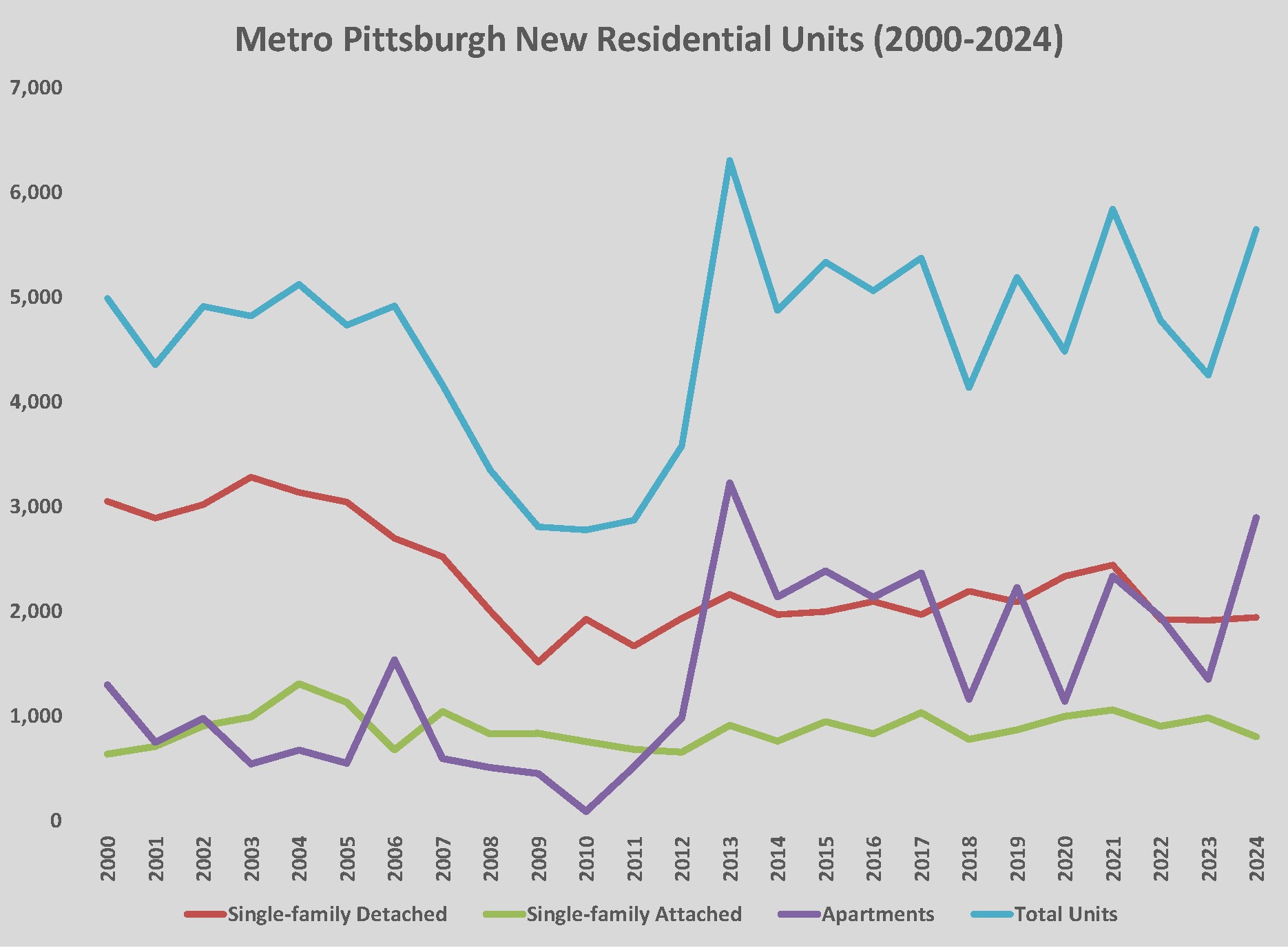

Residential construction saw a dramatic boost from new multi-family projects in 2024. The Pittsburgh Homebuilding Report estimates that builders started 5,645 total units regionwide in 2024, based upon building permit data through November 30. More than half that total, or 2,892 units, will be multi-family units. New single-family construction is expected to be off by 70 units compared to 2023, primarily due to a 15 percent decline in townhouse construction.

The decline in new townhomes is likely also a function of limited supply, this time of materials and building products. A survey of entitled lots for townhouse construction does not show a decline; however, disruptions in the supply chain caused by the fall hurricanes and the massive hurricane rebuilding efforts since 2023 have created unpredictable delays and unavailability. Because townhomes are typically built faster than detached single-family homes, unexpected delays have a bigger impact on schedule. Builders have been reluctant to get too far ahead of their townhouse sales, even when sold out.

The recent Comprehensive Housing Market Analysis for Pittsburgh done by the Department of Housing and Urban Development (HUD) offers good insight into the reasons for the durability of demand for housing. Based upon consensus population and employment forecasts, HUD estimates that 10,500 new households will be formed in the three-year period beginning in May 2024. Using historical household formation-to-housing demand ratios for Pittsburgh, HUD forecasts that the demand for new single-family homes will increase by 10,450 by May 2027. Currently, there are fewer than 1,500 homes for sale under construction. With demand for new homes growing at almost three times the rate of new construction, a greater share of new households will be renters.

Builders are cautiously optimistic about 2025 because of the continued strong demand and post-election improvements in sentiment. The dynamics of the new construction market changed significantly in 2022, when the nation’s largest builder, D.R. Horton, began building in Pittsburgh. The NVR builders, Ryan Homes and Heartland Custom Homes, have maintained a market share of between 40 percent and 50 percent for a decade, depending on the year. The Horton business model, which builds dozens of spec homes for sale in new communities, is likely to disrupt the land development market. The aggressive build-and-sell model has the potential to stimulate more lot development.

In 2025, a continued tight existing home inventory should give a boost to new construction, if builders can find available lots.

“We are optimistic. All the economic indicators are positive post-election. There seems to be a little bump in demand from people who are sitting on the sidelines. Interest rates look like they should improve slightly over where they are,” says Liam Brennan, vice president of Infinity Custom Homes. “In our market in the affluent suburbs of northern Allegheny and southern Butler County, we feel pretty confident. We’re expecting perhaps 10 percent growth.”

“If it wasn’t for the election, I would think our business would continue to be the same. We are not overly busy, but we are definitely not slow,” says Jeff Costa, CEO of Costa Homebuilders. “With Donald Trump making a promise to make housing more affordable, putting in policies or incentives to build more housing would help everyone in the market. How aggressive the administration is may determine our year.”

The election has provided optimism to builders who are not particularly upbeat about the housing market. The National Association of Homebuilders conducts and publishes a monthly Housing Market Index (HMI) in conjunction with Wells Fargo. The December HMI builder confidence reading was steady and slightly negative at 46, but the outlook for new homes sales soared to 66. That was the highest level in three years and was due to builders’ belief that there would be regulatory relief coming in 2025.

Even with the cautious optimism, builders are still concerned about the supply of lots.

“The supply side continues to be a challenge. I think it will increasingly be a challenge,” says Brennan. “We are fortunate to have some projects in the pipeline that should come online next year, but the process of getting lots through local approvals and the Department of Environmental Protection is getting more difficult. And it seems like there are fewer developers out there.”

Residential development has become less desirable over the past two decades, even more so since rates spiked in 2022. Ever-increasing regulatory burdens have added time and cost to new developments. Construction costs and land prices have soared. New development is done with a commercial construction loan, which currently carries a variable rate that is above eight percent. Those kinds of borrowing costs make it difficult to endure the patient take-down pace that a custom home community requires. Waiting five to seven years to realize the return on investment is not worth the risk that comes with residential development. Most of the new development, and new developers, are more comfortable developing for production-style builders who complete projects within two years.

Costa is somewhat comfortable in his prediction because his business is primarily custom homes on a buyer’s lot. Costa Homebuilders is less dependent upon land development and more reliant upon individuals who feel good about the economy.

“We’re still developing land but it’s for our clients’ lots,” says Costa. “We are building on lots that are up to 60 acres. We still have to bring in utilities and driveways, but it’s for one homeowner. It’s becoming expensive to develop a lot, and we are seeing more people demolishing houses to create a lot. It may be one in four of the projects I’m doing now. When I think about the lot shortage, I think there may be more teardowns.”

It is unlikely that anyone had “buying homes to tear them down” as the solution to the lot shortage in Pittsburgh, but few alternative solutions have been offered. Looking towards 2025, the Pittsburgh housing market is in something of a no-lose situation. For new construction, lots will continue to be scarce, and demand will be strong. Builders with brand recognition or with land in desirable communities will have reason for optimism. For home buyers, the passage of time seems to be motivating more homeowners who want to sell to put their home on the market; however, mortgage rates will probably keep this at a trickle, not a deluge.

Presidential elections have a way of removing uncertainty, regardless of the outcome. That is good for business. Even with bold promises of more affordable housing, the incoming administration will struggle to make changes that shift the market dramatically. But if regulations on development and lending are loosened, there is likely to be noticeable improvement. In Pittsburgh, a reliably solid economy will keep demand strong. It is hard to imagine circumstances that would produce a gangbuster year, but it is even harder to imagine a bad year. Pittsburghers will have to settle for slow and steady once again. NH