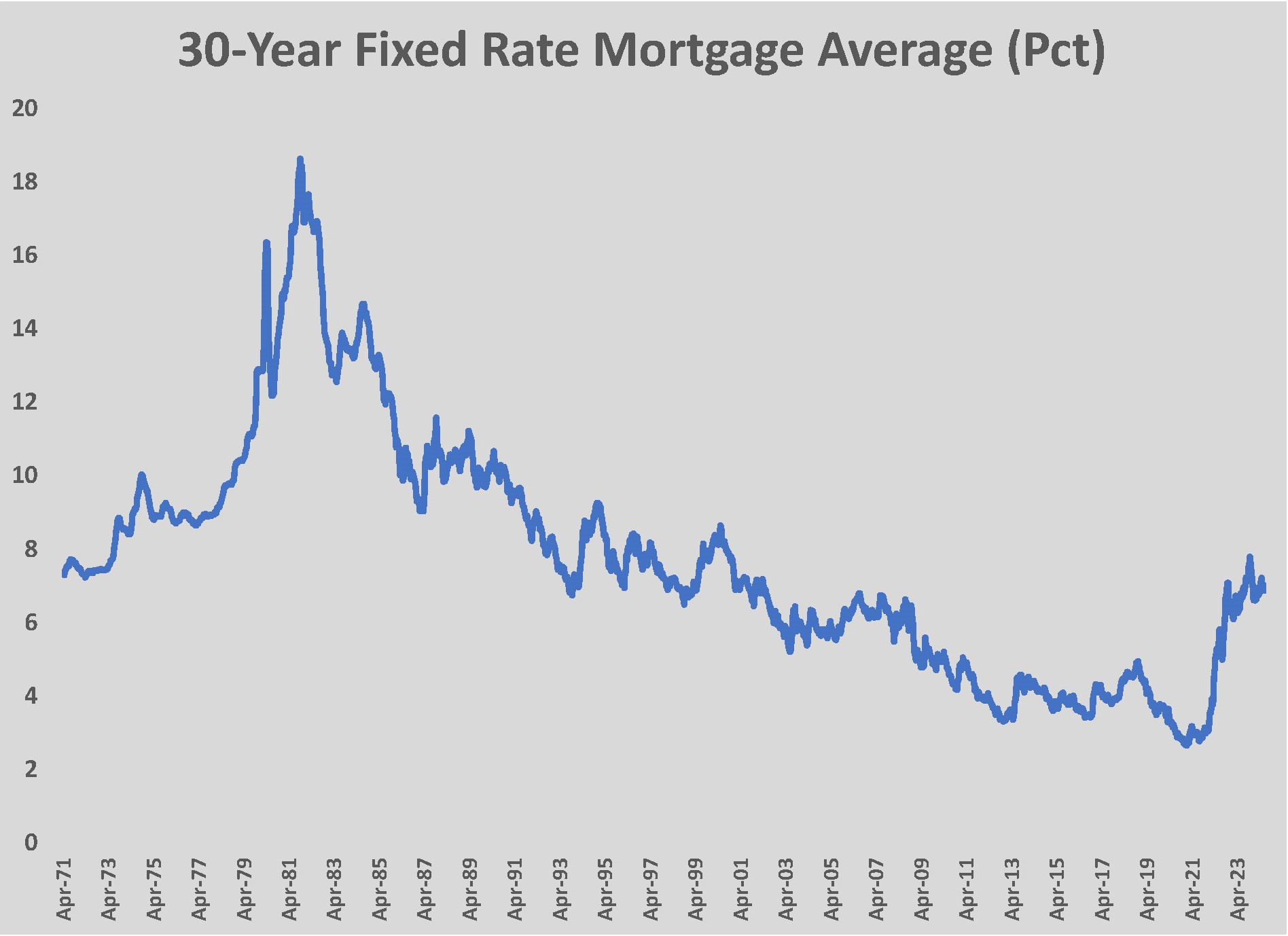

Although the factors driving long-term rates, like 15-year and 30-year mortgage rates, differ from those that determine interest rates for short-term loans and bonds, a change in direction of the latter always predicts a change in direction for the former. By mid-2023, when the Fed stopped its rate hikes, 30-year mortgage rates had topped seven percent.

Compared to the history of the 30-year mortgage, the seven percent rate was average. In fact, the average rate for a 30-year mortgage since 1974 is 7.83 percent. For most homeowners over the age of 50, their first fixed-rate mortgage had a double-digit rate. But it had been more than two decades since the 30-year mortgage rate topped six percent, and at least a decade since rates peaked above five percent. For those who purchased or refinanced a home during 2020 and 2021, their mortgage was likely below three percent.

The mortgage rate environment that existed post-Great Recession was quite unusual; however, its duration was sufficient that a generation of homeowners came to accept it as the norm. The reality, of course, is that there is no “normal” in the mortgage market. The simple, boring dynamics of supply and demand dictate how much interest banks and other lenders will ask borrowers to pay to offset the risk of making a loan.

As might have been expected, a spike in mortgage rates of nearly four percentage points – more than doubling in one year – had a chilling effect on homeownership. This chilling effect was especially felt by first-time homeowners, many of whom lived in places where home prices were going up at rapid rates. There was also a downstream effect of sorts. Millions of homeowners who wanted to upgrade or downsize found themselves trapped in place by a mortgage that was too low to give up, especially since there was widespread belief that rates would retreat in a couple of years after inflation had been brought under control again.

Markets have a funny way of defying expectations. More than two years after rates began rising, there is little certainty about when they will begin to pull back, or how low they will go. The reasons that people were looking to buy or sell a home since 2022 probably did not change in the intervening two years. Empty nesters still want to downsize. Renters still want to own. Young families still need more room. As “higher for longer” drags into year three, the question is: will homeowners accept conditions as the “new normal” or will it take lower mortgage rates to bring relief?

Why Are Rates So Much Higher?

Some of the dynamics are influenced by the conditions of the individual lender, but most are the result of factors beyond the control of any individual lender. More than any other single factor, mortgage rates are influenced by the capacity and policy aims of the government-sponsored entities (GSE), Fannie Mae and Freddie Mac.

Lenders that hold mortgage loans in their portfolio have asked for higher rates to offset the risk of higher inflation. The majority of home mortgages are sold to investors in the form of mortgage-backed bonds. These transactions, which involve roughly 70 percent of residential mortgages, are known as the secondary market. The largest purchasers in the secondary market are Freddie Mac and Fannie Mae. For that reason, lenders conform their borrowing standards to meet those of Fannie and Freddie, giving outsized influence to the prevailing policies at the GSEs.

Since the Federal Reserve began tightening rates, Fannie and Freddie have not moved much to relax lending standards and have asked a slightly higher spread from borrowers. The spread is the additional interest that lenders will ask above a recognized rate, such as the rate for a 10-year Treasury bond. That spread is supposed to reflect that risk of the borrower’s default. In uncertain economic times, or in times when inflation is running higher, the spread will be higher. Over the course of time, 30-year mortgage rates have tended to run 1.5 percent to 2.0 percent higher than the 10-year Treasury. While the Fed was aggressively hiking rates from March 2022 until mid-2023, the spread between the 10-year and the average 30-year fixed mortgage jumped to three percentage points. That spread is currently close to 2.5 percent.

Lenders’ spreads are also influenced by supply and demand for mortgages. In times of tight capacity, like following the Great Financial Crisis in 2008, the low supply of loans will push mortgage rates higher. The same is true when there is a great demand for mortgages, or when the competition from borrowers is high. Spreads are also higher when there are fewer buyers of mortgage-backed securities. Such is the case today.

Now that the Federal Reserve Bank has paused its rate hikes for a year, the likelihood of another leg up in mortgage rates is very low. That should help lenders feel more confident about the future (although the uncertainty about a slower economy remains). At the same time, higher rates and greatly reduced inventory of homes for sale have depressed the overall demand for residential mortgages. That has had a negative impact on the business of banking.

The top 27 publicly owned banks saw mortgage banking income fall 20.5 percent in 2023. Five of them recorded losses as a result. Of 21 publicly owned banks with mortgage operations, the decline in originations and sales to the secondary market was 32.1 percent last year. Mortgage servicing for others, a service that lenders provide that boosts their income, fell noticeably in the fourth quarter of 2023, eroding profits further.

It might be easy to feel unsympathetic to the plight of the banks, but troubles in the banking sector always trickle down to consumers. Unlike 15 years ago, the current troubles do not appear to be systemic or catastrophic. But declining profits and a heightened sense of risk never translates to an easier mortgage market and will be a source of upward pressure on mortgage rates. That is another reason why mortgage rates are not likely to trend downward once the central bank begins cutting its Fed Funds rate later this year.

When Will Rates Fall?

Coming into 2024, there was significant optimism about mortgage rates coming down. Even the conservative Federal Reserve Bank chair, Jerome Powell, alluded to the probability that rates would be cut as many as three times in 2024 when he spoke following the December 2023 Federal Open Markets Committee meeting. Hotter inflation readings during the first quarter of 2024, many of which did not necessarily indicate that inflation was heating up again, tempered the optimism. Better inflation reports in May and June have eased some of the anxiety about reinflation, but most observers do not expect a cut in the fed Funds rate until September or later.

If a lower Fed Funds rate does not directly impact long-term borrowing rates, like residential mortgages, what else might bring rates down? The short and truthful answer is, not much. It is possible that a sharp rise in unemployment or other macroeconomic shock could push lenders to lower rates to attract borrowers, but those are extremely unlikely scenarios, ones that would bring greater concern than a seven percent mortgage.

Forbes magazine recently asked national organizations that are integrally involved in the housing market about their forecast for mortgage rates. The prevailing sentiment was that mortgage rates would remain near the current levels until the markets were more certain that inflation has been tamed and is on its way back to the two percent range by the end of next year. Most of those surveyed forecasted that rates were going to slip in 2024 but revised those forecasts higher after the first quarter. From among the responses were:

Freddie Mac forecasts that the Fed will make only one cut in 2024 and mortgage rates will remain above 6.5 percent through 2024.

Fannie Mae increased its average rate forecast for the second half of 2024 from 6.6 percent to 7.1 percent. Its chief economist, Doug Duncan, sees rates trending lower in 2025.

National Association of Realtors (NAR) expects the 30-year fixed mortgage rate to gradually fall to 6.5 percent by year’s end and to average 6.7 percent for the full year 2024.

Bank of America’s head of retail lending, Matt Vernon, says that the bank’s global economists do not anticipate a Fed rate cut until December, but forecasts that 30-year rates will stay below seven percent from mid-year.

Mortgage Bankers Association (MBA) predicts that 30-year mortgage rates will average 6.7 percent in the third quarter of 2024. The MBA forecasts a Fed Funds cut in September and a second before year’s end. It expects the 30-year rate will be 6.5 percent at the end of 2024.

KPMG Economics is more bearish on mortgage rates for 2024. It expects the Fed will be cautious about rate cuts to prevent a reacceleration in inflation, waiting until December for the first cut. KPMG predicts 30-year mortgage rates to be in the seven percent range through the spring 2025 buying season.

Palisades Group, a manager and investor in residential property and loans, predicts 30-year rates will stay above 6.25 percent through 2024.

Lawrence Yun, chief economist at NAR, predicted that long-term interest rates overall were likely to fall further than mortgage rates will after monetary policy reaches equilibrium.

“The Federal Reserve is delaying and is cautious about inflation, but six to eight rounds of rate cuts through the end of 2025 are likely to bring the interest rates down from current high levels to match those during the pre-COVID years,” said Yun, in a May press statement. “Do not expect any major declines in mortgage rates, however.”

These forecasts are noticeably higher than the prevailing wisdom six months ago, following Powell’s doveish outlook at year’s end. The same is true for Pittsburgh regional residential real estate professionals, most of whom expected the 30-year mortgage rate to be close to the six percent line by mid-2024.

Tom Hosack, president/CEO of Berkshire Hathaway Home Services The Preferred Realty, was optimistic that rates might move below six percent, but that was when the 30-year fixed rate was 6.25 percent in December. Now, he sees the outlook unchanged from that time.

“I believe we will see one cut in November leaving rates around 6.25 to 6.50 percent at end of year,” he says.

Mike Henry, senior vice president of residential lending for Dollar Bank, was surprised so many experts were predicting that mortgage rates would fall significantly in 2024. Henry notes that Dollar Bank’s rate is currently 6.75 percent, slightly higher than it was at the end of 2023 but more or less where he expects it to be for the foreseeable future.

“We’ve been hovering at that rate even with some market ups and downs,” says Henry. “What we see is rates are going to stay in this range. I don’t know what would cause them to go in either direction unless there was some inflation report that was unexpected. It seems to me that things have settled into this range and that we are here for a while.”

Henry echoes the growing sentiment that higher mortgage rates have become baked into the expectations of buyers, that any problems with affordability are not turning on the mortgage rate.

“It is worth noting that interest rates have not prevented people from buying homes. The bigger problems have been the higher cost of homes and the low inventory of available homes for sale,” Henry says. “The other interesting thing is that we’re seeing more loans over $1 million than we ever have.”

Asked if he thinks higher mortgage rates are keeping buyers on the sidelines, Howard “Hoby” Hanna IV, chief executive officer of Howard Hanna Real Estate Services says, “No, I don’t. I’m not sure that the Fed keeping rates higher is having the desired effect on housing.”

Hanna offers that the tighter monetary policy, which was intended to cool demand and inflation, has failed to dent the increase in home prices. He looks optimistically towards 2025 with the hope that lower rates might be an incentive for sellers to put more homes on the market.

“I think we’re going to see rates stay where they are for the balance of this year. I was hoping they would come down a little bit and we might still see some small dips in rate,” says Hanna. “I think 2025 will be a better year and we’ll see rates come down. We’ll see stabilization between the 5.5 percent and 6.25 percent range.”

What’s Ahead for Home Buyers?

With each month that passes, it is becoming clearer that the mortgage rate environment that existed between the Great Recession and the pandemic will be the outlier from the long-term trend. The conditions that prompted central banks to drop rates near zero were extraordinary and the deleveraging that was necessary for consumers and businesses took place without triggering a series of recessions, like what happened in the 1970s. But long-term interest rates that barely topped the rate of inflation, as U.S. home buyers experienced for more than a decade, are unsustainable. Mortgage interest rewards the lender for taking the risk of lending money for 30 years. That risk did not go to zero between 2009 and 2022. A return to the long-term trend was inevitable.

At the same time, each passing month homeowners and prospective home buyers are becoming more accustomed to the “new normal” of rates. That does not mean they like a seven percent mortgage; however, the passage of time allows homeowners to adjust their plans and expectations. The passage of time also builds a pent-up demand for new mortgages once rates begin to fall.

“It is worth noting that interest rates have not prevented people from buying homes. The bigger problems have been the higher cost of homes and the low inventory of available homes for sale,” Henry says. “The other interesting thing is that we’re seeing more loans over $1 million than we ever have.”

First-time buyers are saving their money get additional time to save. Homeowners who are holding off on moving up because they do not want to trade their three percent mortgage for one that has more than double the interest payment still want to trade up. That builds the demand for the middle and upper price range of homes. The same is true for empty nesters who have deferred downsizing while rates are high. It is the empty nester’s home that is the target for the move-up buyer. History has shown that the longer an interest rate-sensitive buyer waits, the more likely they are to respond quickly once rates start to fall. If that trait of human nature holds true, the prospects for 2025 are very good.

For lenders, the impending moderation in mortgage rates represents two potential upticks in business. Aside from the expected increase in homebuying activity, a wave of future refinancing is building. Millions of mortgages have been closed since rates moved higher. If even modest expectations of where mortgage rates will settle prove correct, the mortgages written in 2022 through 2024 will be ripe for refinancing once rates move below six percent. It is estimated that the owner of the average-priced home in the U.S. financed at seven percent will save nearly $200 per month at 5.5 percent. That is more than enough to trigger refinancing.

The problem for lenders is that so few homeowners have mortgages at rates that would benefit from refinancing. According to the Federal Home Finance Administration (FHFA) roughly 70 percent of the mortgages in the U.S. are more than three percentage points lower than the current market rate. For perspective, from 1998 through 2020, the average share of borrowers with rates that were below the current market rate at the time was 40 percent. At the beginning of 2024 Redfin calculated that 78.7 percent of homeowners had mortgages below five percent, and 59.4 percent were below four percent. Those numbers are down from 2023, but the conditions are still very poor for refinancing.

Until mortgage rates do return to that 5.5 percent range, homeowners and prospective home buyers can find some relief in the competitiveness of the current housing market. There are still far more buyers than sellers, so prices are not going to come down anytime soon; however, with rates stuck above 6.5 percent, lenders and homebuilders are being as creative as possible to bring the cost of home purchasing lower.

Buyers should shop around. There is still a rationale for adjustable mortgages. Lenders are offering rates that can vary by as much as .25 percent. Homebuilders are offering mortgage point buydowns. Shorter term mortgages can be as much as three quarters of a percentage point lower than a 30-year mortgage. An experienced real estate agent or mortgage broker can help trim hundreds off a monthly payment. That can mean the difference between affording a home or not.

The U.S Treasury Department announced measures to help with housing affordability on June 24. Treasury Secretary Janet Yellen outlined a handful of programs aimed at boosting the supply of homes for lower-income buyers. Several were tweaks to existing policies, but two of the programs could have a larger impact.

Yellen announced that the Treasury Department will devote $100 million over three years to a new program at the Community Development Financial Institutions (CDFI) Fund primarily focused on increasing the supply of affordable housing. This will allow the CDFI Fund to make its funds go further to support the production of housing that is affordable to low- and moderate-income households. The CDFI Fund projects that this new funding could support the financing of thousands of affordable housing units.

Also announced were revisions to rules governing the Capital Magnet Fund to allow more of the fund’s resources to support production and preservation of housing. Last year, the Capital Magnet Fund made over $320 million in awards that leveraged more than $11.1 billion in resources to support affordable housing. Awardees planned to develop more than 32,700 affordable housing units.

For much of the housing market, affordability will be improved by an increase in the housing supply, which would bring price appreciation back to long-term norms. A normalization of the mortgage market will help boost supply. Lower rates will make more development projects economically feasible and increase demand for new homes with lower mortgages.

What has happened to the mortgage market since mid-2022 can be easily explained as a delayed reaction to the conditions that arose after the housing bubble burst and the 2007 mortgage crisis sparked a global recession. Since World War II ended, interest on a 30-year fixed mortgage only fell below seven percent in 2002, when the Bush administration policy pushed the housing market as the cure for an ailing economy. Even in that more accommodating environment, mortgage rates stayed between 5.5 percent and 6.5 percent until the bottom of the Great Recession in spring 2009. As long-term rates for bonds and other debt fall throughout 2025, it is unrealistic to expect the fixed 30-year mortgage to fall much further than one percentage point or so.

That scenario will be tough for buyers looking to see a rebound to the pre-pandemic days; however, lenders report that buyers – even first-time buyers – are adjusting to a housing market where mortgage rates will remain above five percent. That adjustment period may take a few more years but the marketplace is coming to accept again that five or six percent is a reasonable rate of interest to pay for borrowing money for 30 years.

Adjusting to a new normal can be painful but if normal means reliable, it will be better for buyers, sellers, and lenders in the long run. NH